Track Your Gig Income Like a Pro: Introducing Ride Income Calculator

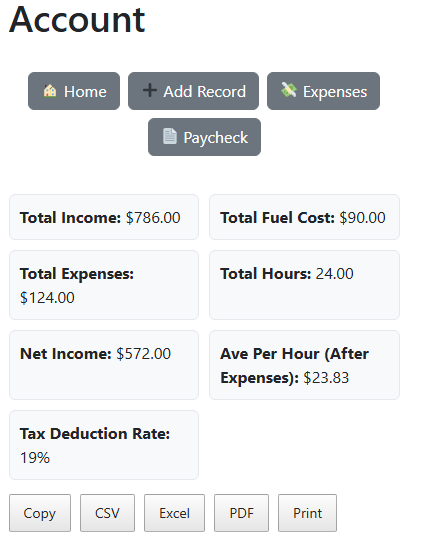

Track Your Gig Income Like a Pro Whether you drive for Uber, Lyft, DoorDash, or any other gig platform, Ride Income Calculator helps you track your earnings, expenses, and hourly rate with precision. Here’s how it works—and why it matters. Log Your Daily Stats Each day, enter your trips, distance, driving hours, earnings, tips, and … Read more