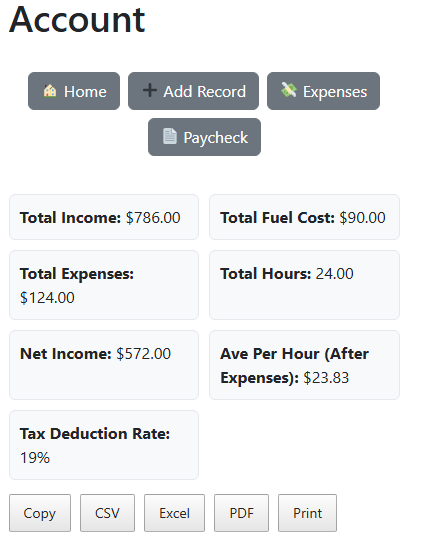

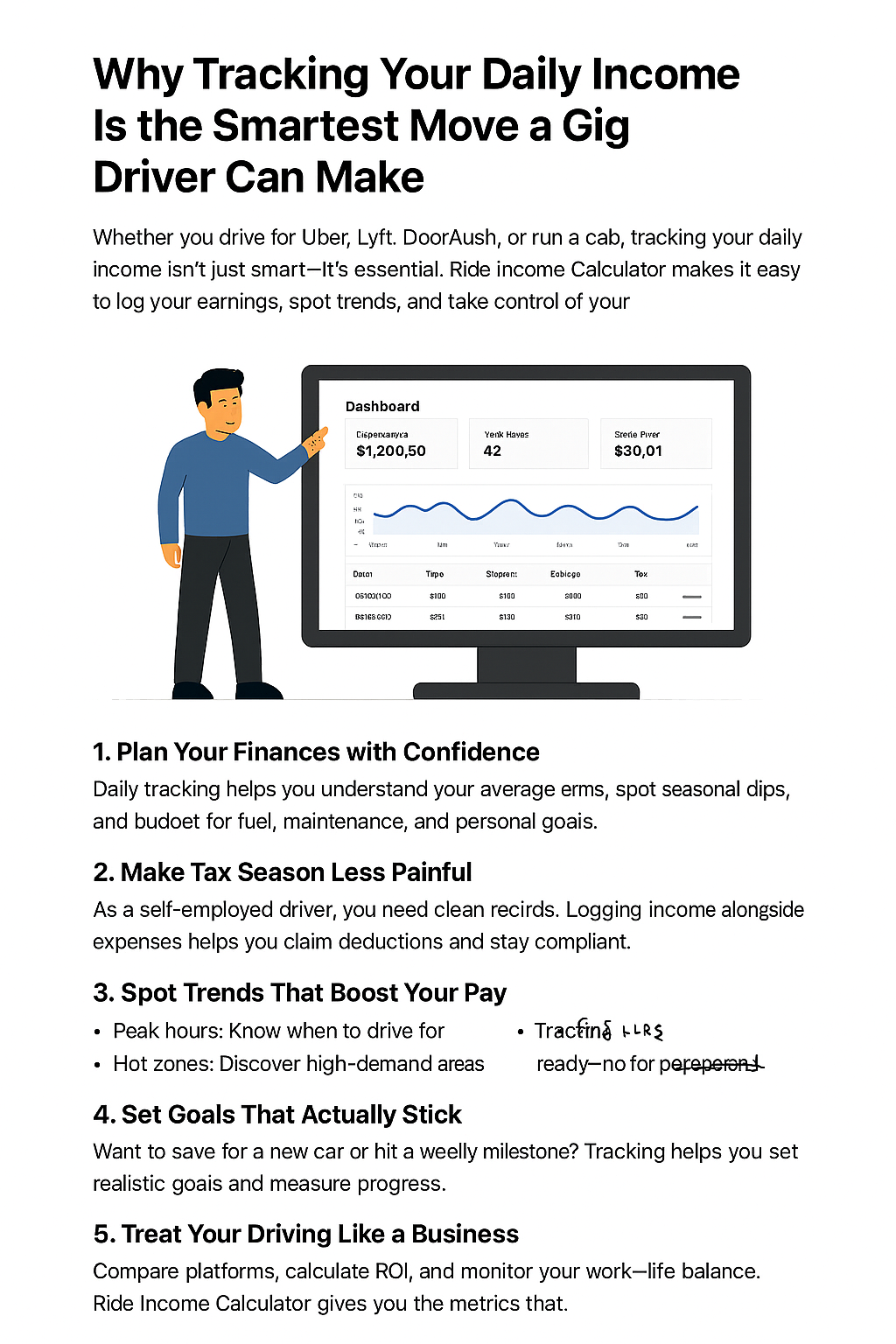

Whether you drive for Uber, Lyft, DoorDash, or run a cab, tracking your daily income isn’t just smart—it’s essential. Ride Income Calculator makes it easy to log your earnings, spot trends, and take control of your financial future.

1. Plan Your Finances with Confidence

Daily tracking helps you understand your average earnings, spot seasonal dips, and budget for fuel, maintenance, and personal goals.

2. Make Tax Season Less Painful

As a self-employed driver, you need clean records. Logging income alongside expenses helps you claim deductions and stay compliant.

3. Spot Trends That Boost Your Pay

- Peak hours: Know when to drive for max earnings

- Hot zones: Discover high-demand areas

- Seasonal spikes: Plan around events and holidays

4. Set Goals That Actually Stick

Want to save for a new car or hit a weekly milestone? Tracking helps you set realistic goals and measure progress.

5. Treat Your Driving Like a Business

Compare platforms, calculate ROI, and monitor your work-life balance. Ride Income Calculator gives you the metrics that matter.

6. Be Ready for Emergencies

Unexpected repairs or bills? Your income history helps you build a buffer and stay prepared.

7. Simplify Loan and Aid Applications

Need to prove income for a loan or financial assistance? Your logs are ready—no scrambling for paperwork.

How to Get Started

- Manual entry: Log rides and earnings daily

- Spreadsheet import: Use Google Sheets or Excel

- Dashboard tools: Filter, export, and analyze your data

As a ride-share or cab driver, you might find yourself focusing more on the number of rides completed or the miles driven than on maintaining detailed records of your daily earnings. However, consistently tracking your income is a fundamental habit that can yield significant long-term benefits. Here’s why recording your daily income is essential and how it can enhance your professional and financial success.

1. Accurate Financial Planning

Tracking your daily income gives you a clear picture of your earning patterns. With accurate data on how much you earn daily, weekly, and monthly, you can:

- Budget Effectively: Knowing your average earnings helps you allocate money for fixed expenses, savings, and discretionary spending.

- Plan for Variations: Ride-share and cab driving often have income fluctuations due to seasonality, weather, or special events. By analyzing past records, you can plan ahead for slower periods.

2. Tax Preparation Made Easier

Ride-share and cab drivers are typically considered self-employed, making it your responsibility to report your income accurately. Keeping a daily log of earnings can help you:

- Avoid Overpaying Taxes: When you track income alongside expenses like fuel, car maintenance, and tolls, you can claim deductions effectively.

- Stay Compliant: Accurate records protect you in case of an audit, as you’ll have documentation to substantiate your reported earnings.

3. Identify Income Trends

Daily income tracking allows you to identify patterns and trends over time. You might notice:

- Peak Earning Hours: Track which times of day bring in the most income and adjust your schedule accordingly.

- High-Demand Locations: Discover which areas generate more frequent or higher-paying rides.

- Seasonal Opportunities: Recognize the best months or events to maximize your income.

4. Improve Goal Setting

Setting financial goals becomes more attainable when you understand your earning capacity. For instance, you can set specific targets like:

- Saving for a new car or maintenance fund.

- Achieving a weekly earnings milestone.

- Planning for personal goals, such as vacations or debt repayment.

5. Gain Professional Insights

As a professional, treating your ride-share or cab business like a small enterprise is vital. Recording your income daily can help you evaluate:

- Performance Metrics: Compare your earnings across different platforms or shifts.

- Return on Investment (ROI): Understand how much you’re earning relative to your costs.

- Work-Life Balance: Determine whether you’re overworking for diminishing returns.

6. Prepare for Emergencies

Financial stability requires knowing how much money you can count on. With detailed records:

- You can build an emergency fund proportionate to your income variability.

- You’ll be better equipped to handle unexpected expenses, like car repairs or medical bills.

7. Simplifies Applying for Loans or Financial Assistance

If you need to apply for a loan, mortgage, or financial aid, banks and financial institutions often require proof of income. Daily income logs serve as concrete evidence of your earnings, especially when combined with bank statements.

How to Get Started

Recording your income doesn’t have to be complicated. Here are some simple tools and methods:

- Manual Tracking: Use a notebook or planner to jot down daily totals.

- Spreadsheets: Use Excel or Google Sheets for automated calculations and data analysis.

- Apps: Many apps are tailored for ride-share drivers, allowing you to log income, expenses, and mileage in one place.

- Integrated Tools: Leverage income-tracking features offered by your ride-share platform or taxi software.

Conclusion

Recording your daily income as a ride-share or cab driver is more than just a financial chore—it’s an investment in your future. By understanding your earnings, planning your finances, and preparing for taxes, you can transform a routine job into a sustainable and profitable venture. Start today, and watch how this simple habit empowers you to take greater control of your financial journey.

Happy driving and happy tracking! 🚗💰

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.